ANALYSIS: Students face financial reality of inflation

While starting salaries rose 14% between 2010-2020, the cost of many goods or necessities has risen very sharply since last year alone.

Campus Reform analyzed the changing cost of common expenses like a used car, gas, auto insurance, and rent to see how recent graduates' salaries fare in today's economy compared to previous years.

A recent Real Estate Witch survey found college students overestimate what they will earn at their first jobs by nearly double. While students expect to make $103,880, the average starting salary is $55,260.

“Students expect a higher starting salary because it costs more money to afford basic expenses in the United States,” Real Estate Witch Spokesperson and economist Danetha Doe told Campus Reform.

[RELATED: Graduating students are concerned about entering the job market as inflation soars]

“The current inflation rate is 8%,” Doe said. “The implications of high inflation combined with stagnant wage/salary growth are mental health challenges arising from financial instability.”

Campus Reform has reported that college students are unhappy with the country’s track under President Biden. Those students soon entering the workforce are particularly concerned about the economy and inflation.

While college graduates’ starting salaries rose 14% between 2010-2020, the cost of many goods or necessities has risen very sharply in the last few months alone.

Inflation has made basic expenses less affordable for new graduates.

Campus Reform analyzed the changing cost of common expenses like a used car, gas, auto insurance, and rent to see how recent graduates’ salaries fare in today’s economy compared to previous years.

Average starting salary

According to annual surveys conducted by the National Association of Colleges and Employers, the average starting salary has risen by $6,909 since the Class of 2010 entered the workforce.

Class of 2015: $50,219

Class of 2020: $55,260

The Class of 2022 is projected to make between $50,681-$75,900 on average, depending on the student’s major, with humanities majors making the least and seeing the largest decrease from the previous year. Salaries for humanities majors are projected to be $50,681 in 2022, versus $59,500 in 2021.

The annual income increased 14.3% between 2010 and 2020. However, starting salaries for humanities majors have decreased by 14.8% between 2021-2022.

Average used car prices

According to an analysis by iSeeCars, the average used-car cost in 2022 is now set at $34,429.

That number represents a nearly 15% increase from December 2021 and a 67% increase since 2019.

2019 average: $20,618

December 2021 average: $29,969

With auto production expected to return to normal levels as chip manufacturers begin to meet demand again, J.D. Power projects costs will drop by early 2023. Higher prices are expected to remain, however, over the coming months.

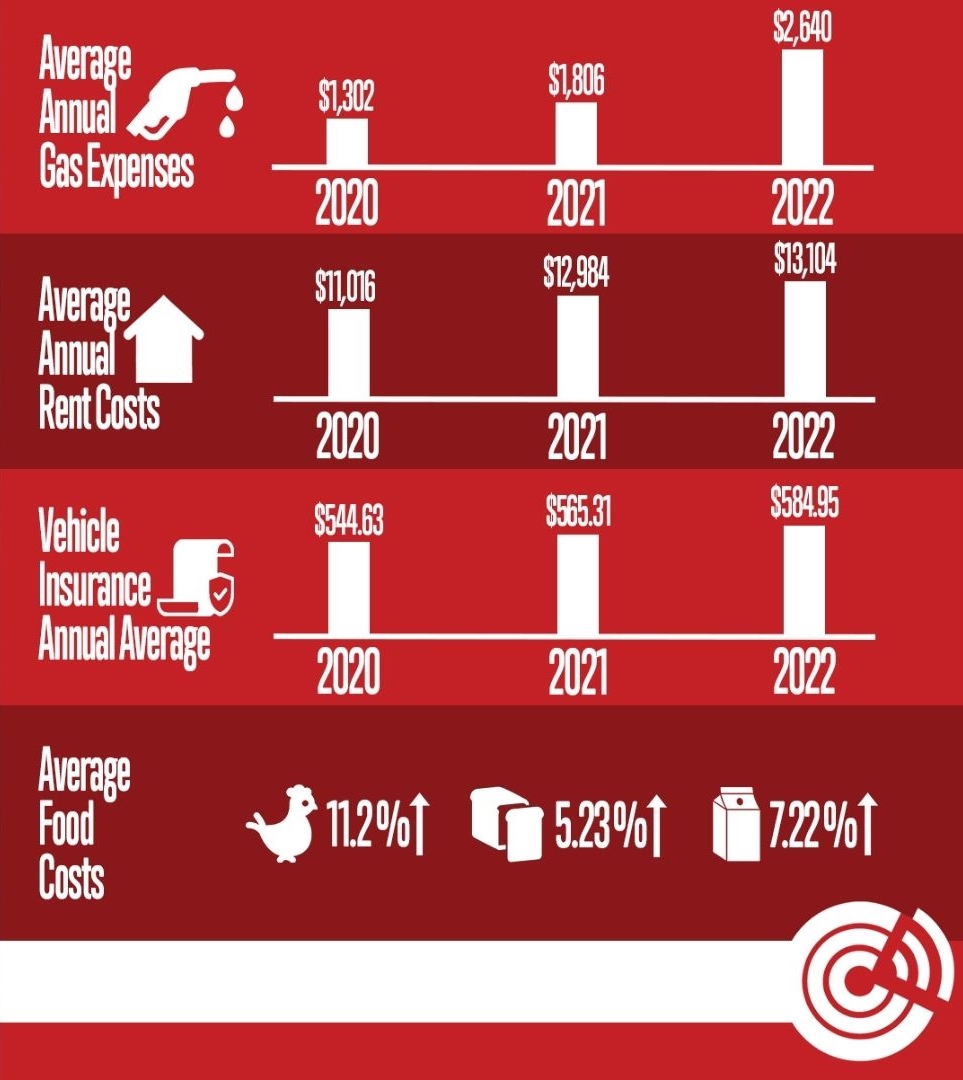

Average annual gas expenses

The average driver uses nearly 600 gallons of gas each year, based on U.S. Department of Transportation numbers. According to Statista, annual gas prices have fluctuated over the past decade.

2020: $2.17 ($1,302 annually)

2021: $3.01 ($1,806 annually)

May 23 2022: $4.60/gallon ($2,760 annually)

But in the last year alone, the average gallon of gas has increased by nearly 53%, according to AAA data.

Average annual rent costs

Statista statistics on the average cost of a studio apartment also reveal a significant increase.

December 2020: $918 ($11,016 annually)

December 2021: $1,082 ($12,984 annually)

February 2022: $1092 ($13,104 annually)

Rent prices increased by 18% between December 2020 and December 2021. Rent jumped 1% in the two months between December 2021 and February 2022.

Vehicle insurance annual average

According to the annual average on the US Bureau of Labor Statistics Consumer Price Index, average annual vehicle insurance rates increased by 7.4% between 2020 and 2022.

2020: $544.63 ($45.39/month)

2021: $565.31 ($47.11/month)

Mar 2022: $584.95 ($48.75/month)

Rates are up 3% since last year.

Food costs

Food is a major cost for new graduates. Below are samples of basic ingredients that show how much food prices have been affected by inflation.

Chicken

According to the US Bureau of Labor Statistics Consumer Price Index, one pound of chicken increased 11% between December 2021 and April 2022 alone.

Dec. 2020: $1.62/lbs

Dec. 2021: $1.61/lbs

Apr. 2022: $1.79/lbs

Bread

Dec. 2020: $1.54/lbs

Dec. 2021: $1.53/lbs

Apr. 2022: $1.61/lbs

Between December 2021 and April 2022 alone, the price increased 5%.

Milk

Dec. 2020: $3.54/gal

Dec. 2021: $3.74/gal

Apr. 2022: $4.01/gal

A gallon of milk has increased in cost by 21% since 2010. Between December 2021 and April 2022 alone, the price increased 7%.

New Clothes

Starting a new job often means purchasing a new wardrobe. As the price of cotton increases, the cost of clothing will also experience an uptick. According to Bost Innovation, cotton is “one of the most commonly used materials in clothing.” 63% of cotton fibers are used to manufacture apparel, and nearly 70% of the market buys cotton to produce clothing.

Cotton costs

2020: $0.78/lbs

2021: $1.13/lbs

May 2022: $1.43/lbs

The price of cotton is up 26.5% since last 2021.

These numbers collectively suggest that recent college graduates will not only be making less than expected but will also struggle more to meet the costs of living than graduates in recent years.

This situation is made worse by the fact that, according to an analysis by the Federal Reserve Bank of NY last year, 40% of recent college graduates are underemployed.

Inflation, in combination with other factors, continues to hit recent graduates with a harsh reality.

Infographic by Avery Selby